Charitable Trust Basics: What They Are and Why You Might Want One

If you’ve ever heard the term “charitable trust” and wondered if it’s something you could use, you’re not alone. In plain terms, a charitable trust is a legal arrangement where you set aside money or assets to support a cause you care about. The trust holds the assets, a trustee manages them, and the benefits go to the charity or community project you pick.

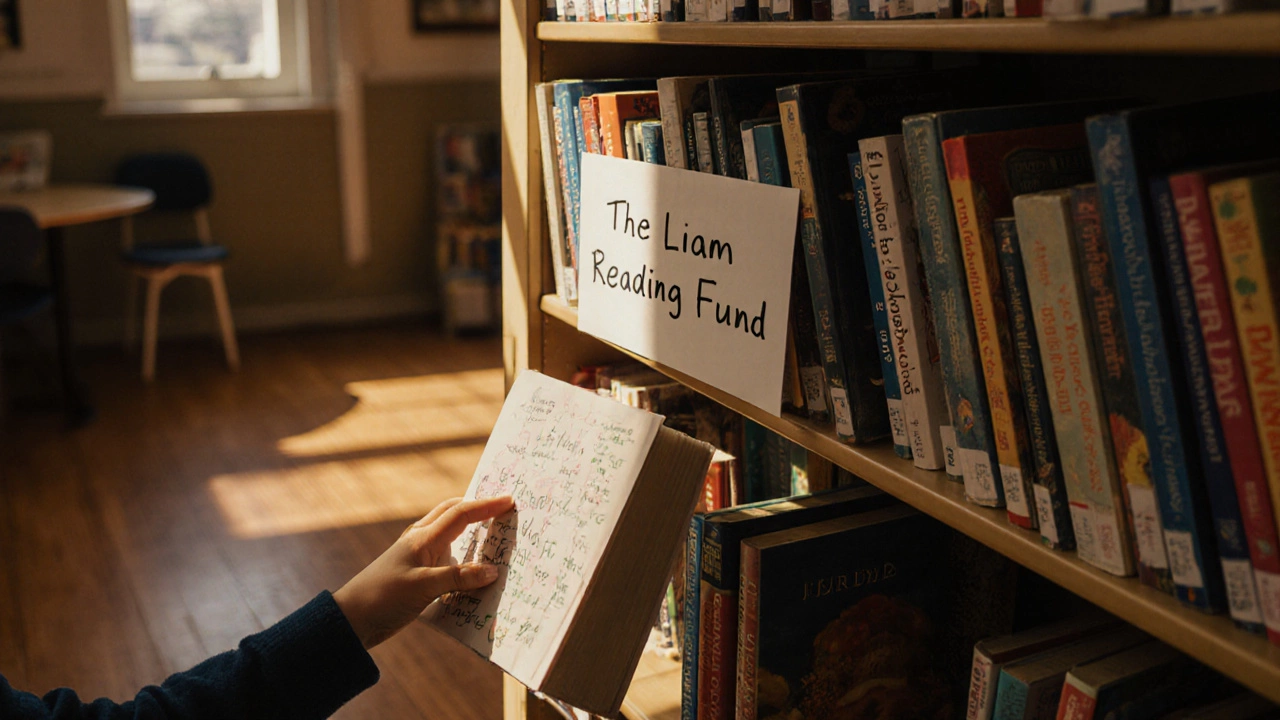

People choose charitable trusts for a few practical reasons: they can reduce taxes, they let you control how the money is used, and they keep the funds working for a cause long after you’re gone. Think of it as a way to turn your generosity into a lasting legacy without the hassle of daily management.

How to Set Up a Charitable Trust – Step by Step

Getting a trust off the ground isn’t as scary as it sounds. Here’s a quick rundown of the key steps:

- Define Your Goal. Decide what cause you want to support – education, health, the environment, or even a local community project.

- Choose the Trust Type. Most people pick a charitable remainder trust (CRT) if they want to keep some income for themselves, or a charitable lead trust (CLT) if the charity gets income first.

- Pick a Trustee. This can be a trusted friend, a professional firm, or a bank. The trustee makes sure the trust follows the law and your wishes.

- Draft the Trust Document. Work with a solicitor or a qualified adviser to write the legal paperwork. It spells out how assets are managed, who gets paid, and when the charity receives money.

- Fund the Trust. Transfer cash, stocks, real estate, or other assets into the trust. For real estate, you’ll need a clear title and might have to file a new deed.

- Notify the Charity. Let the charity know they’ll be receiving funds. Some charities even help you customize the trust to fit their needs.

Most people can get a basic charitable trust set up in a few weeks if the paperwork is in order. Complex assets or larger sums can add a few months, but the process is straightforward with the right guidance.

Do Charitable Trusts Last Forever? What Affects Their Lifespan

One common question is whether a charitable trust can run forever. The short answer: yes, but it depends on the trust’s terms and local laws. A “perpetual” trust is designed to keep giving out income or grants indefinitely, but some jurisdictions limit how long a trust can exist – often 80 or 100 years.

Factors that affect longevity include:

- Trust Language. If you write the trust to terminate after a set period, it will end then.

- Asset Performance. If the trust’s investments shrink, it may not sustain payouts.

- Legal Changes. New regulations can force a trust to wind up earlier than planned.

Real‑world examples show many trusts thriving for decades. For instance, the Holy Family Catholic Church in Patchway runs community outreach programs funded by a charitable trust that’s been active for over 30 years. The key is good planning, regular reviews, and sensible investment strategies.

So, whether you’re thinking about putting your house into a charitable remainder trust, setting up a fund for a local cause, or just curious about how trusts work, the basics are simple: define your goal, pick the right structure, get solid legal help, and keep an eye on the trust’s health. With those steps, you can turn today’s generosity into tomorrow’s impact.

Can You Take Money Out of a Charitable Trust? Here’s What Really Happens

You can't take money out of a charitable trust for personal use-it's legally bound to support a nonprofit. Learn why, what alternatives exist, and how to avoid costly mistakes.

Read More

What Can You Do With a Charitable Trust? Practical Uses and Real-World Examples

A charitable trust lets you support causes you care about forever - with tax benefits, control over how funds are used, and the power to leave a lasting legacy. It's not just for the wealthy.

Read More

Charitable Trust vs Charitable Remainder Trust: Key Differences Explained

Learn the key differences between a charitable trust and a charitable remainder trust, including structure, tax benefits, payout options, and how to set them up.

Read More

Charitable Trust Advantages and Disadvantages: A 2025 Guide

Explore the real pros and cons of creating a charitable trust, including tax savings, control issues, setup costs, and how they shape philanthropy in 2025.

Read More

Should You Start a Charitable Trust? Expert Advice and Tips

Thinking about setting up a charitable trust? This guide covers what you need to know—benefits, steps, costs, and tips for making it work for you.

Read More

Charitable Trust Structure: Step-by-Step Guide to Formation and Success

Thinking about starting a charitable trust? Learn how to structure one, stay compliant, choose the right trustees, and maximize your impact.

Read More

Can a Trust Pay Taxes Instead of Beneficiaries?

Ever wondered if a charitable trust can handle taxes so beneficiaries don't have to? This article breaks down how trusts pay taxes, when taxes fall on beneficiaries, and what makes charitable trusts unique. You'll find out how trust rules play out in real life and discover practical tips to minimize tax headaches. Perfect for anyone managing, setting up, or benefiting from a charitable trust.

Read More

CIO Disadvantages in Charitable Trusts: What to Watch Out For

Thinking about switching from a charitable trust to a CIO? It's not all smooth sailing. This article breaks down the hidden drawbacks of CIOs you won't hear at board meetings. From less flexibility to confusing regulations, we'll look at why some charities regret making the move. Get ready for honest insights, not just textbook pros and cons.

Read More

How Charitable Trusts Avoid Capital Gains Tax: Simple Strategies Explained

Ever wondered how charitable trusts can dodge massive capital gains tax bills? This article digs into why donating assets like stocks or property through a trust can save serious money on taxes. You'll get smart tips, some real-world tricks, and learn why timing and setup matter so much. We'll even clear up common myths people still believe about how this tax break actually works. Perfect if you want to support a cause without handing tons of cash to the taxman.

Read More

Can a Charitable Trust Invest? Smart Ways to Grow Your Good Deeds

Ever wondered if a charitable trust can put its money to work through investments? This article digs into how charitable trusts handle investing, what rules they need to play by, and what risks to watch for. You'll find practical tips for trustees who want to boost what their trust can achieve. See real-life examples, clear explanations, and some watch-outs you shouldn't ignore if you're running—or donating to—a charity. Let's break down the basics so you can make smarter decisions for a good cause.

Read More

Structure of a Charitable Trust: What You Need to Know

Explore the ins and outs of a charitable trust's structure. Understand its legal foundation, key components, and how it operates. Uncover helpful tips and insightful facts to navigate the complexities of forming and managing a charitable trust effectively.

Read More

Charitable Trust Basics: Essential Requirements to Get Started

Thinking about setting up a charitable trust but don't know where to start? This article covers everything from defining what a charitable trust is to the key requirements needed for its establishment. Learn about legal factors, trustee roles, and common pitfalls in setting up a trust. Make sure your charitable intentions are backed by solid structures. Grab tips on how to maintain compliance and security.

Read More